Small businesses may be the engine of the economy, but they’re often overlooked by governments and big businesses. That is why the Canadian Federation of Independent Business (CFIB) was founded—to represent the interests of small businesses, provide information and advice when they need it and negotiate with big providers on their behalf with the might of its 110,000 members. Still, over its 50-year history, CFIB has never seen its members face a challenge as devastating as COVID-19.

Getting answers: At the start of the pandemic, the situation was changing so quickly and profoundly that it was difficult for business owners to keep track and stay on top of the news, let alone figure out how to restructure their business to protect staff and comply with new rules. CFIB’s Business Helpline was so in-demand that we pulled in staff from other departments working in near round-the-clock shifts to ensure our members got the help they needed fast. Quickly, CFIB opened up the Helpline to all small businesses, not just our members. As a result, we have answered more than 50,000 inquiries from business owners since the beginning of the year, almost double the amount for all of 2019.

All business owners can now get free one-on-one advice from CFIB’s team of experts, as well as access our exclusive webinars and savings programs simply by registering at cfib.ca/introductoryoffer.

Influencing governments’ response to COVID-19: With information changing by the hour and governments rushing to respond to an evolving situation, CFIB reached out directly to our members with weekly surveys to find out what they need most and conveyed the information to the government through briefing calls, letter and the media. Our staff were on the phone with senior government officials daily, pushing for measures that could support the needs of small businesses.

Plummeting revenues and forced closures meant that business owners quickly needed help covering their employees’ wages and fixed costs like rent. CFIB was an early advocate of a 75 to 90 per cent wage subsidy. When the federal government announced its initial 10 per cent subsidy, we pushed back hard, in meetings with government officials and through thousands of media appearances, and we were successful in raising it to 75 per cent.

While the government’s latest round of changes to the Canada Emergency Wage Subsidy extended the program to the end of the year, CFIB is also fighting to ensure the many family businesses that pay themselves through dividends and who are not currently eligible for wage support are covered.

Cash flow for fixed costs like rent or utilities was another emergent issue for small business owners. CFIB worked closely with government to ensure the Canada Emergency Business Account loan program was accessible to as many businesses as possible, and has succeeded in expanding access to those with no payroll, but who can demonstrate non-deferrable expenses exceeding $40,000, and recently businesses with personal banking accounts. Despite this, new firms, and those with less than $40,000 in non-deferrable expenses are still left out of getting the help they need, and CFIB continues to advocate for their inclusion.

Another issue that small businesses continue to face is access to meaningful rent relief. While the federal government’s commercial rent assistance program was a good initial step, the program’s flawed and unfair design has left many businesses in need of relief unable to access it because their landlord doesn’t wish to apply on their behalf or because they don’t qualify. CFIB is pushing government to give the relief directly to commercial tenants.

The fight continues: Many firms have been helped by these federal support programs, but changes are still needed to help small firms recover and ensure more businesses are able to survive the COVID-19 crisis. That’s why CFIB launched a new online petition to push government to make these important changes to its relief measures. All business owners can join the fight for better COVID-19 relief at cfib.ca/covidpetition and tell policy makers what changes are most important to them.

Getting businesses the help they need directly: In the background of our advocacy work, we were also aware that business owners needed to stay informed. We launched a very popular weekly webinar series, where business owners could get the latest information about new government programs and ask questions directly to CFIB’s senior leadership team.

When a business owner on one of the webinars raised the need for a small business marketplace to procure personal protective equipment (PPE), CFIB launched PPEs for SMEs, a Facebook group that connects small business producers of PPE products with those looking to purchase them.

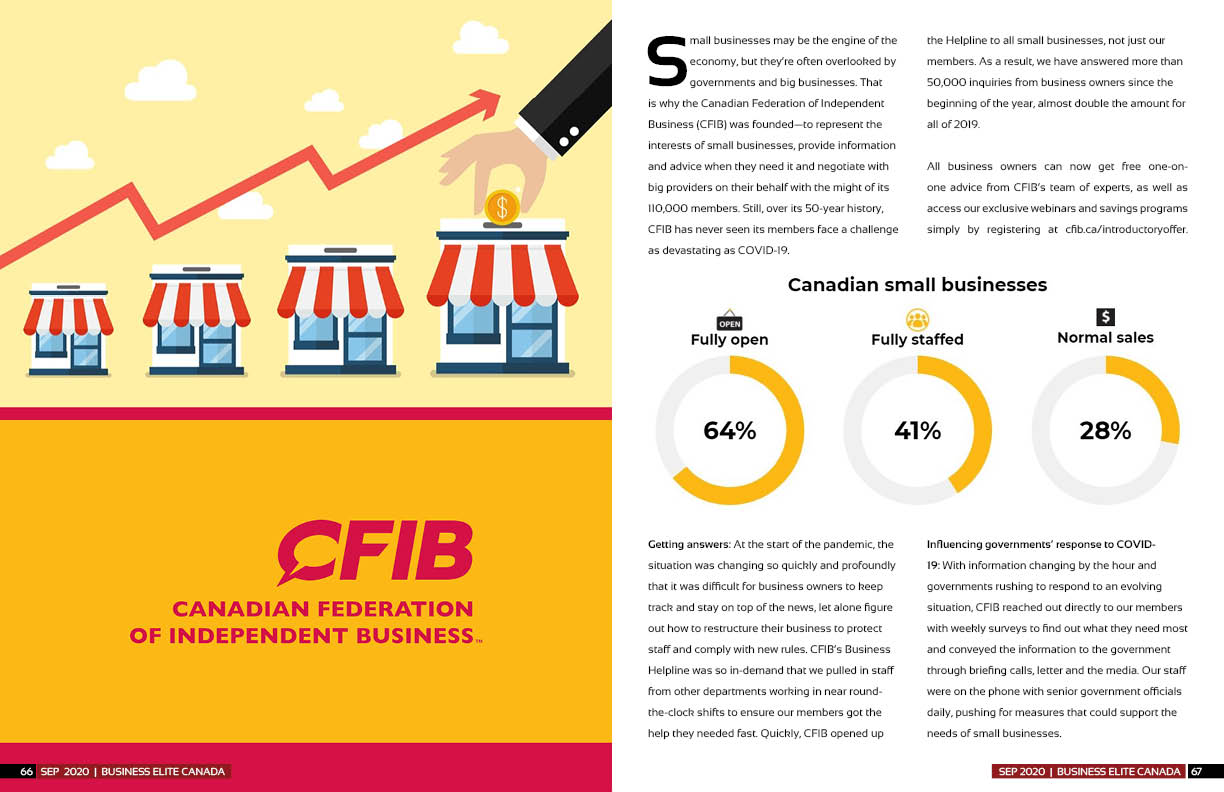

Promoting shopping local: Small firms are far from business as usual. While six in 10 businesses are fully open as of August, only a quarter are making normal sales and 60 per cent of business owners are worried consumer spending will remain low even after the pandemic. In fact, a recent CFIB report estimated that Canada may lose 158,000 small businesses (one in seven) if they don’t receive more support.

CFIB’s latest initiative, #SmallBusinessEveryDay, tackles the need to increase sales by encouraging Canadians to shop at their local independent businesses. At smallbusinesseveryday.ca, consumers can find fun and easy ways to support local economies, like visiting a new business or planning a Canadian vacation. The website also features information about all the other initiatives that have been launched to support small business recovery. Visitors can also find up-to-date information about the health of small businesses at the Small Business Recovery Dashboard.

You’re not alone: Being a small business owner is often a lonely calling: it means working long hours, wearing many hats, worrying about your employees, all the while feeling like you’re swimming upstream against unhelpful or sometimes detrimental government programs. It helps to have support in your corner when a crisis as unpredictable as COVID-19 hits: this is why joining the 110,000 small businesses who are members of CFIB is one of the best investments a business owner can make.