By Anna Guy

Canada has become a global player in the diamond industry, and Kennady Diamonds is a new kid on the block.

Canada has become a global player in the diamond industry, and Kennady Diamonds is a new kid on the block.

Dr. Rory Moore is the CEO and President of Kennady Diamonds. In Canada since 1989, Moore has unparalleled experience in Canadian diamond exploration. He consulted for renowned Canadian geologist named Chuck Fipke and his company DiaMet Minerals in the lead up to the discovery of diamonds in Canada in 1991, and then went on to be the exploration manager for BHP after the Australian mining giant partnered with DiaMet to evaluate the discovery and ultimately build Canada’s first diamond mine, Ekati.

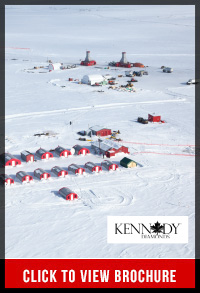

Since then, Canada has become one of the Top 5 diamond producing countries. Toronto-based Kennady diamonds is continuing this new era. Located 280 kilometers east-northeast of Yellowknife, NWT, the Kennady North Project consists of 22 mineral leases and 58 mineral claims covering 67,164 hectares.

In exploration since 1992 (with a hiatus between 2003 and 2011), the Kennady North Project culminated with the discovery of the Kelvin and Faraday kimberlites. Exploration work has not only been done by Kennady. In fact, initial exploration was conducted under the direction of Mountain Province Diamonds as the 100 percent owner.

History of Kennady Diamonds

Mountain Province and De Beers Canada formed a joint venture in 1997 to explore and evaluate a promising diamond discovery called Gahcho Kué. This discovery has subsequent been developed into the Canada’s newest diamond mine, with commercial production being declared in March of this year. Back in 2012, Mountain Province and De Beers collectively owned most of the ground that Kennady is currently working on. “The focus of the Joint Venture at the time was on evaluating the Gahcho Kue discovery and very little money was being spent on exploring the surrounding property,” explains Moore.

Nevertheless, Mountain Province’s CEO at the time, Patrick Evans, felt there was good exploration potential on the neighbouring grounds and negotiated a transaction where Mountain Province bought De Beer’s 51 per cent interest in the property for $10,000. Mountain Province then went on to form Kennady Diamonds in May 2012 with the sole mandate of exploring the Kennady North Property.

The investment paid off. “To put that in context, Kennady Diamonds is now worth $160 million dollars on the stock exchange (as of August, 2017),” says Moore. Since that initial exploration, Kennady Diamonds has gained a great deal of momentum, and is now in the process of building an economic diamond deposit. With the backing of businessman and financier Dermot Desmond, the company is on the path to finding a new source of Canadian diamonds.

A Fresh Focus

In late 2015, the board of Kennady implemented an initiative to operate more independently of Mountain Province. Two new independent directors were appointed in early 2016, and Moore was hired on as the new CEO as of May, 2016.

Since then, Kennady’s focus has been on formally defining the diamond resources discovered to date on the project. In December 2016, the Company announced an Indicated Resource of 13.62 million carats for the Kelvin kimberlite, and the goal for 2017 is to advance the Faraday kimberlite to Inferred Resource status. “We had a very successful winter program this year, with bulk samples acquired from the three Faraday kimberlites using wide diameter reverse circulation drilling techniques”, said Moore. Over the summer, the Company announced high diamond grades from these samples and an average diamond value of US$109 per carat. “These results will ensure that the Faraday kimberlites will add significant high-grade tonnes to the growing diamond resource on the Kennady North Project”.

Kennady has recently completed a summer exploration program that focused on further delineating the Faraday kimberlites. Moore is excited by the fact that the summer drilling has added another 150 metres to the length of the Faraday 2 kimberlite, which he says should add approximately one million tonnes of high grade resource potential to the project. He says that the systematic approach that the technical team is taking to exploring the property is paying off handsomely as the Company strives to achieve its objective of building a large enough diamond resource to support economic development.

“We still have a way to go to support a stand alone mine, but the property offers excellent potential for additional discoveries” says Moore. Being located so close to an operating diamond mine also opens up potential opportunities for collaboration with the Gahcho Kué Joint Venture.

One thing is for certain, with Moore at the helm, and with positive results continuing to come in, Kennady Diamonds could be the next big thing in the both NWT and the TSX.