Creditors with Ethics

~ By Emily Innes

Canadian Credit Protection Corporation sets itself apart from other collection agencies by having an innovative human resources policy and professional collection techniques, according to CCPC’s vice president Rick Mislov, who brings over 20 years of credit and financial experience to the company. “We pride ourselves in being a full service national solution, while maintaining an intimate approach”.

“Not all collection agencies have state-of-the-art technology and ongoing training. We have invested a lot in compliance and security and in our rich corporate culture and we try to adapt with the times,” Mislov told Business Elite Canada. “We are also very client-focused, so if our client needs a certain type of service then we gear up towards that client’s needs.”

CCPC’s mission is to focus on brand integrity by advocating for their clients’ brands and building brand loyalty. They are also focused on providing excellent customer service. CCPC is value-driven, Mislov said, and strives to be innovative while at the same time remaining cost-effective. As CCPC aims to be a people-centric company, it recruits, trains, and retains talented and enthusiastic employees. Above all, CCPC values being an ethical organization that adheres to all measures of the law and protects clients’ resources and customer data with state-of-the-art security measures.

CCPC provides a variety of collection services

CCPC was founded in Toronto in 1982 and grew to become a successful collection agency. When new ownership took over in 2006, the company was updated and expanded to go nationally. The agency offers first-party services, consumer and commercial third-party recoveries, credit investigation and analysis, outsourcing, skip tracing, and legal support services. Mislov explained that CCPC works with industries from “A to Z”.

“We can collect all types of debt, both first party and third party. CCPC services utilities, institutional, financial and government organizations such as parking tickets and student loans,” said Mislov. “First-party collection is where we remind owing parties on behalf of the corporation to collect the outstanding balance.”

CCPC offers personalized service, which means that an account is specifically assigned to a skilled collection professional who will work with that account from start to finish to maximize recovery. The agency is also committed to “green collections” as it strives to become a paperless office. Staff is shredding and recycling, using electronic file transfers and internal processes, utilizing environmentally-friendly printing, and communicating with debtors through email.

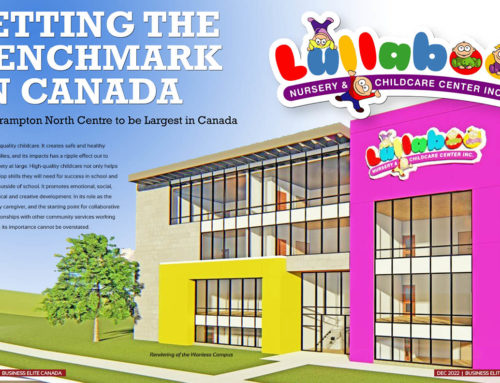

New headquarters is equipped with advanced technology

In 2014, the company moved from its downtown location in Toronto to a larger facility in the city’s north end that is equipped with the latest technologies to be able to securely connect with clients and debtors. “With our growth, we moved to a brand new building at Weston Road and Sheppard Ave West and with that new building we brought in all new state-of-the-art technology,” Mislov said. “We have taken on more space to incorporate the growth that we expect and have planned on for over the next five years.”

The company also has smaller satellite offices located in Vancouver and Montreal. CCPC currently employs approximately 35 people and has room to grow to up to about 80 employees.

Compliance and security features include Canadian Government Security Clearance – Level II; 24-hour alarm protection with closed circuit surveillance cameras; password-protected computers; extensive backup processes; tamperproof/hacker deterrent software; recording of all calls; saving real-time phone records; locked entryways and cabinets; and equipping all computers with up-to-date programs, firewalls, and current anti-virus/anti-spyware protection. The new location has allowed CCPC to become compliant with the Personal Information Protection and Electronic Documents Act (PIPEDA) and is working towards becoming fully Payment Card Industry (PCI) compliant.

Fostering a professional and dedicated staff

CCPC believes in its well-trained and dedicated people, Mislov said. The company develops a professional staff by following a three-step approach. First, they have an exhaustive interview and evaluation process. They do not focus on previous collection experience, except for industry-specific collections, and instead they seek individuals who demonstrate loyalty, dependability, and strong work ethics.

The second step is to have an intense training session combining classroom and hands-on training. Third is their ongoing training program that emphasizes attention to individual needs, as well as an understanding of how the individual fits into the overall scheme of the company. The refresher courses are offered every 90 to 120 days for those employees in need of an update. Mislov said the company also organizes training sessions every time a new client comes on board to address in detail the client’s specific needs.

Training at CCPC also goes well beyond collection techniques since all staff is taught to treat debtors with dignity and to offer solutions. “We view our debtors as our customers, and our people are trained to listen rather than intimidate. We’re big on zero tolerance around here. It really goes a long way when you look at our higher recoveries and our low complaint rate,” Mislov said.

Vibrant corporate culture

The training program is just part of their dedication to fostering teamwork and creating a strong corporate culture, according to Mislov. The office space has a lounge area with a couch and a television to help their employees cope with what can occasionally be stressful situations.

“When employees are having a bad day, they can escape to the lounge and just chill out for a bit and then get back to work,” said Mislov. “We also have an open door policy with our employees. They can come knock on the doors and talk about any issues.”

Canada is a multicultural country, which Mislov said is reflected in the staff at CCPC. “You walk in here and you can see the multiculturalism within the company. The diversity is good because we all work well together. We make sure to hire people who speak different languages in order to communicate with our debtors, and we always have French-speaking agents on the collection floor for every shift.”

Credit agencies provide needed services

While credit agencies can often get negative publicity, Mislov said it is important to note that the industry employs a large number of Canadians and it offers a needed service.

“If there were no collection agencies around, the cost of doing business would be more than it is today,” Mislov said. “If a financial institution loses a million dollars a year, for example, they know that once they send it to an agency like us they know that out of that million dollars, we will recoup a third of it to 50 per cent . . . so they have not lost the full million dollars.”

He continued, “because what happens is if they thought they would lose a million dollars, then that money has to come from somewhere.” That can lead to higher front-end costs for customers such as increased credit card rates as companies try to recoup their losses.

Reducing front-end price hikes is one of the important roles creditors play in society, he said. “Could you imagine if nobody paid their bills? It would be chaotic out there.”

More information about Canadian Credit Protection Corporation can be found at www.creditprotectioncorp.com.